Publications

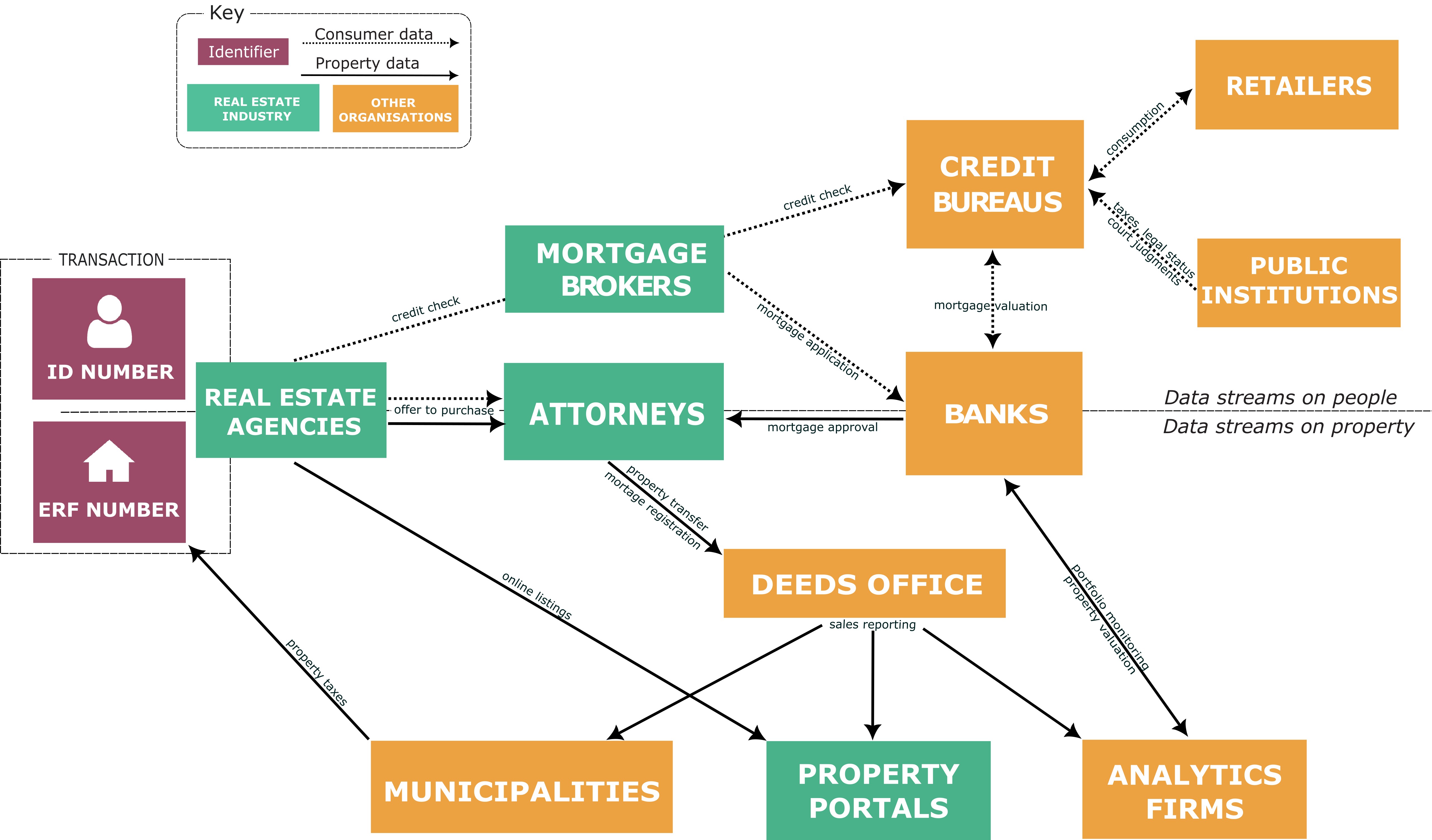

Follow the data: Computing the algorithmic periphery with credit scores and property values

Scoring high, paying up, gating in: middle-class formation and asset inequalities under digital capitalism in South Africa

From the subprime to the premium, from California to fascism?

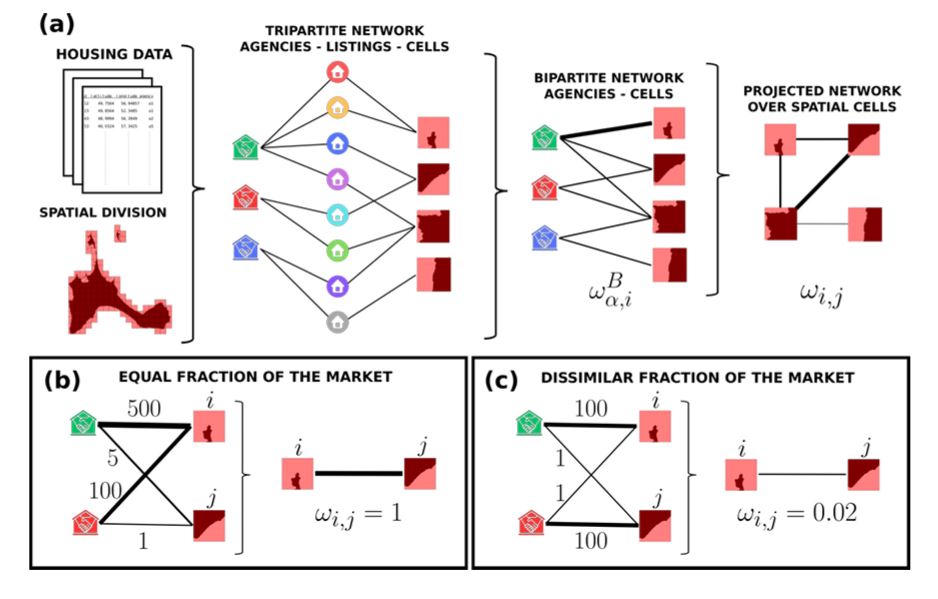

Exploring the spatial segmentation of housing markets from online listings

Maps, Apps and Race: The Market as a Theoretical Machine

The good, the bad and the tenant: rental platforms renewing racial capitalism in the post-apartheid housing market

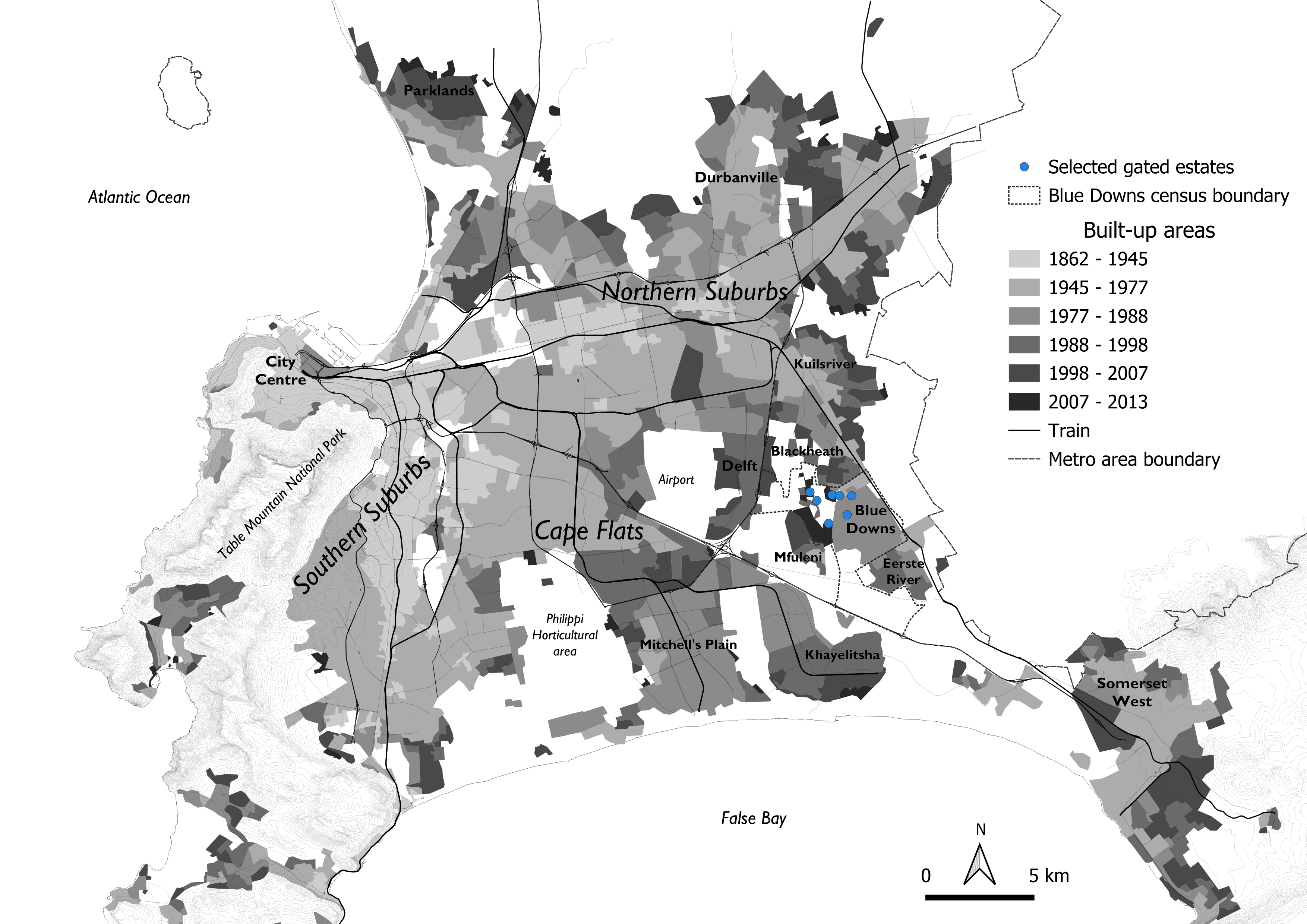

Digital Technology and the City: New Forms of Urban Segregation in Cape Town?

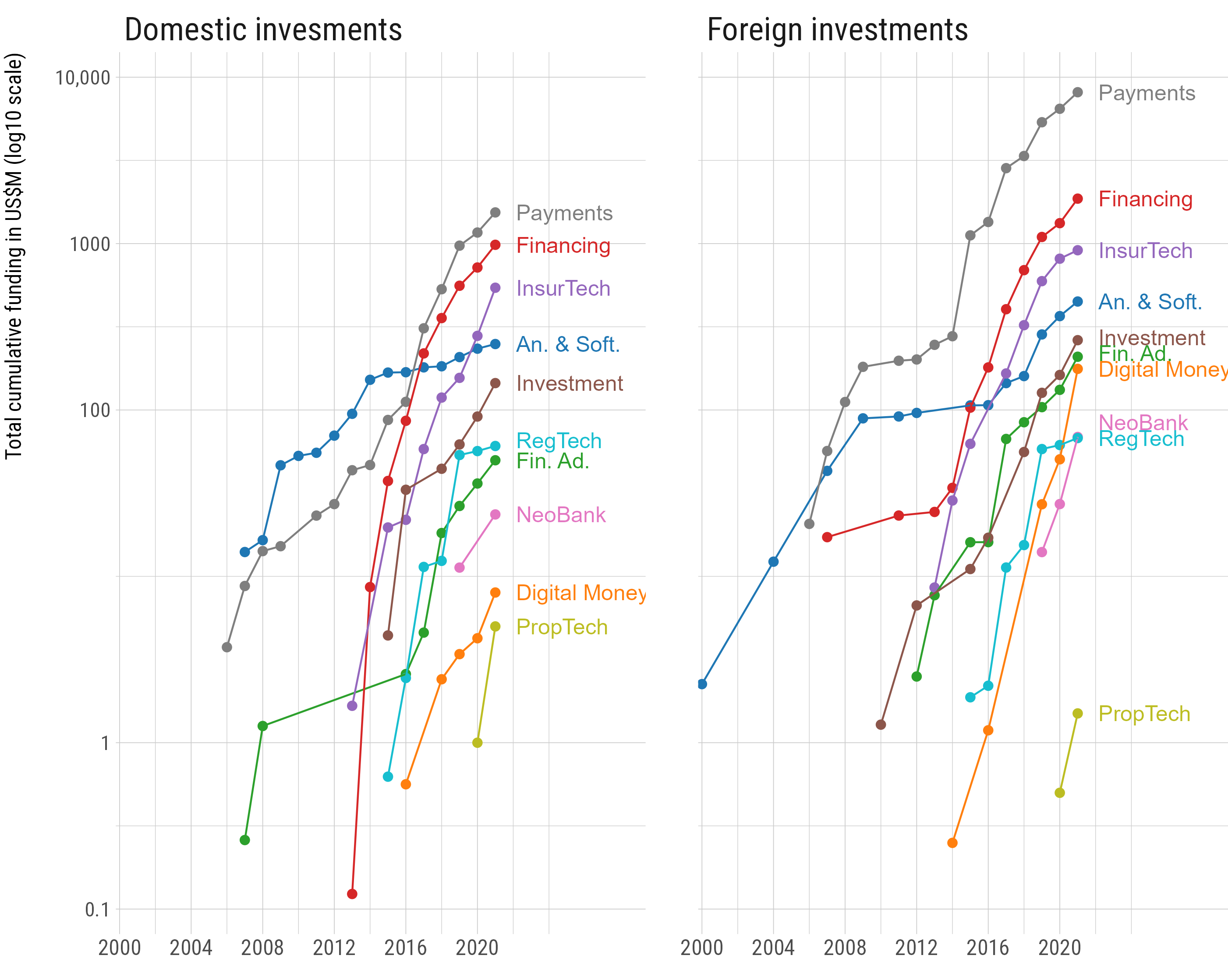

“You should do what India does”: FinTech ecosystems in India reshaping the geography of finance

Ville et numérique : vers un renouveau de la ségrégation urbaine au Cap ?

Housing (In)Equity and the Spatial Dynamics of Homeownership in France: A Research Agenda

Selecting Spaces, Classifying People: The Financialization of Housing in the South African City

Dissertation

2021 Doctoral Prize in Urban Studies, PUCA-APERAU-Caisse des Dépôts;

2021 Dissertation Award in Geography, French National Committee of Geography (CNFG).

2021 Special mention of the jury, Humanities and social sciences PSL Dissertation Prize.

My PhD dissertation was entitled “A city to sell. Digitalization and financialization of the housing market in Cape Town: stratification & segregation in the emerging global city”.

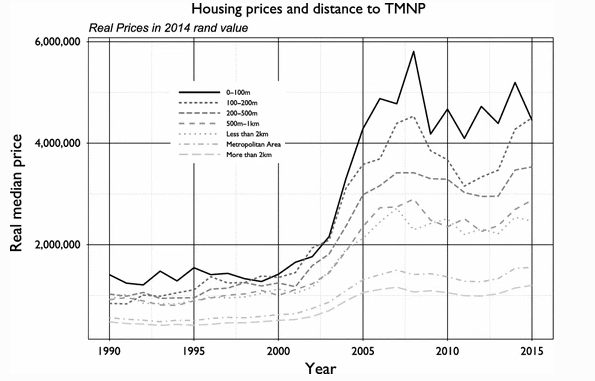

The thesis demonstrates how the digitalization of the real estate industry, structured around the implementation of credit scoring and the rise of real estate platforms, profoundly reshaped the functioning of the housing market in post-apartheid South Africa. This re-mediation of the market enabled a selective financialization of housing, enacted by restrictive lending policies and by the consolidation of the private rental sector, characterized by the emergence of institutional investors. This evolution of the market renewed mechanisms of social stratification and patterns of urban change in Cape Town.

I used a mixed-method framework combining expert interviews, participant-observation, and spatial data science. I conducted 18 months of in-depth fieldwork across the real estate industry (real estate agents, mortgage lenders, institutional investors, buyers and tenants). In parallel, I source Deeds data and longitudinal census data to analyze how the spatial dynamics of price and credit influence the evolution of urban segregation, building a new database of 900,000 residential transactions, while reconstructing the zoning of apartheid with GIS and archival maps. I used open source tools such as R and QGIS.

Public scholarship

- Migozzi J, 2022, “Apartheid by Algorithm”, Logic Magazine.

- Diagonal, 2022, “An interview with Julien Migozzi, recipient of the Doctoral Prize in Urban Studies”, Issue 215.

- Migozzi, J., 2019, “When real estate financialization filters people out”, ideas4development.

- Migozzi, J., 2019, “L’Afrique du Sud : le rugby, un sport de blancs ?”, L’Histoire, n°8.

Media

- Interview for France Culture, “”L’Afrique du Sud : sortir des townships?. Cultures Monde, série”Crises du logement”, Radio France.

- Interview for Libération, “Coupe du monde de rugby 2023 : en Afrique du Sud, les rugbymen noirs gagnent du terrain”.

Early work

- Migozzi, J., 2012, Spatial Justice in Postcolonial Noumea: The Tuband project. MA Thesis / Mémoire de Recherche de Master 2, École Normale Supérieure de Lyon.